New: Flexible service plans for Myra WAF. Learn more!

Home>

Banks & FinTech

Fortify Your Digital Defenses With Myra

4 key areas – 1 outstanding technology

Security

Avoid data theft, system outages, and disrupted communications. Our robust defense system protects your critical processes with unwavering vigilance.

Performance

Experience high-performance delivery of your content, even during traffic peaks. Maintain optimal performance and provide your users with a seamless experience.

Business Continuity

Myra ensures the utmost protection for your business by utilizing direct and geo-redundant connections to your infrastructure, without relying on external factors.

Compliance

Meet the requirements of IT security and data protection teams with ease. Myra is your trusted partner, offering unrivaled expertise in the strictest compliance regimes.

Designed and engineered for highly regulated sectors

Certified Security from Myra: Compliance Without Compromise

ISO 27001 on the basis of IT-Grundschutz (BSI)

Payment Card Industry Data Security Standard (PCI DSS)

BSI C5 Type 2

KRITIS Proof according to § 8a para. 3 BSIG

Trusted Cloud Service

IDW PS 951 Type 2 (ISAE 3402)

VS-NfD

Do you have

questions?

Please contact us via contact form or call us at:

+49 89 414141 - 345.

Protect Your Digital Assets from Malicious Web Traffic

FAQ: Financial Sector and IT Security

DORA (Digital Operational Resilience Act) and NIS-2 (Network and Information Security 2) are two important EU regulations designed to strengthen cybersecurity in the financial sector and other critical infrastructures. DORA aims to ensure the operational resilience of digital systems in the financial sector. It ensures that financial institutions remain operational and financial services remain available even in the event of cyberattacks. NIS-2 harmonizes cybersecurity requirements for critical infrastructure and essential services in the EU. It places particular emphasis on risk management and the reporting of security incidents.

Both DORA and NIS-2 place great importance on security in the digital supply chain. Companies must ensure that their third-party providers and suppliers also comply with cybersecurity standards. This means that financial institutions must not only protect their own systems and processes, but also pay attention to securing their partners and service providers to keep an eye on the entire supply chain. Against this backdrop, choosing a reliable partner with the necessary industry expertise and the corresponding evidence in the form of relevant certifications and attestations such as ISO 27001, BSI C5 or PCI DSS is of great importance.

To protect themselves against cybercrime, financial institutions must develop and implement a comprehensive security strategy that includes both technical and procedural measures. Regular audits, reviews, and updates of security measures are just as important as training and awareness programs for employees and customers. These programs increase awareness of cyber threats and help to minimize the risk of attacks.

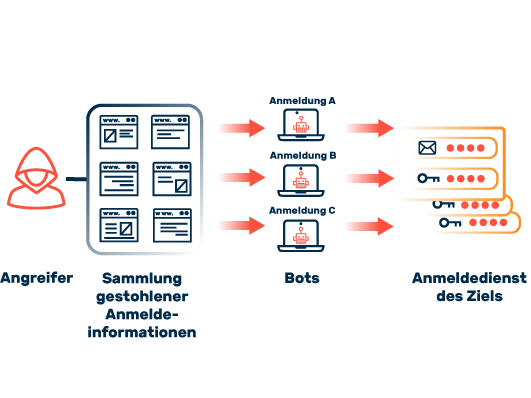

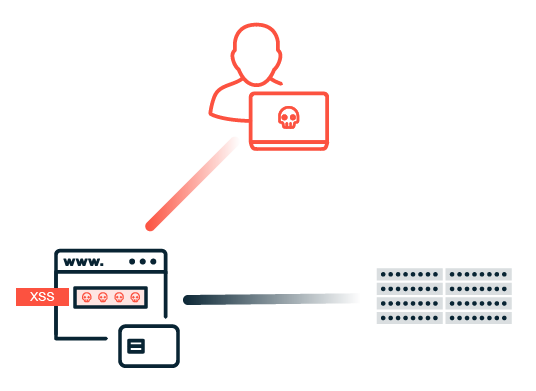

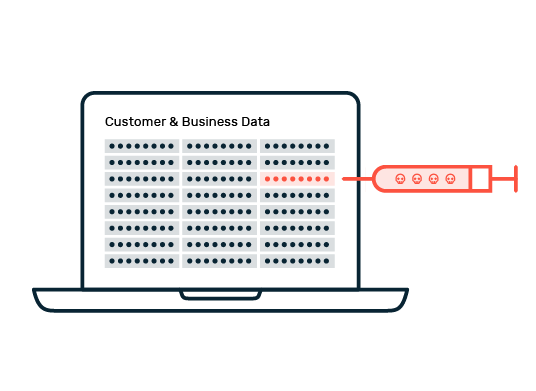

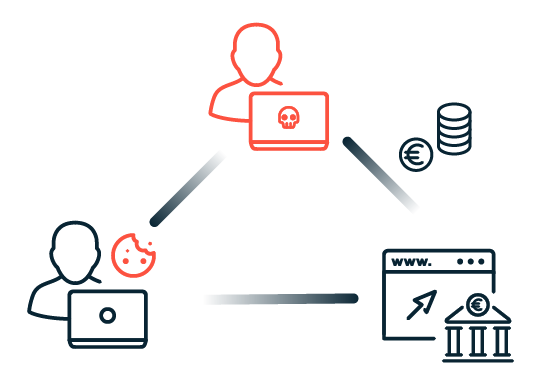

The financial industry is particularly vulnerable to various types of cybercrime. The most common threats include denial of service (DoS) and distributed denial of service (DDoS) attacks, which aim to disrupt the availability of services. Ransomware and phishing attacks are also a threat to banks and financial service providers. Attackers try to extort the highest possible ransom or steal sensitive data – valid bank account or credit card data is traded at top prices on the darknet. Social engineering attacks in turn exploit human vulnerabilities to gain access to confidential information or carry out fraudulent activities. In most cases, it only becomes clear whether IT security can effectively protect banks from such attacks when an actual attack occurs.