New: Flexible service plans for Myra WAF. Learn more!

Home>

Insurance

![]init[](https://www.myrasecurity.com/assets/79302/1674209677-init_logo_farbe_190x74-1.png?auto=format)

Fortify Your Digital Defenses With Myra

4 key areas – 1 outstanding technology

Security

Avoid data theft, system outages, and disrupted communications. Our robust defense system protects your critical processes with unwavering vigilance.

Performance

Experience high-performance delivery of your content, even during traffic peaks. Maintain optimal performance and provide your users with a seamless experience.

Business Continuity

Myra ensures the utmost protection for your business by utilizing direct and geo-redundant connections to your infrastructure, without relying on external factors.

Compliance

Meet the requirements of IT security and data protection teams with ease. Myra is your trusted partner, offering unrivaled expertise in the strictest compliance regimes.

Designed and engineered for highly regulated sectors

Certified Security from Myra: Compliance Without Compromise

ISO 27001 on the basis of IT-Grundschutz (BSI)

Payment Card Industry Data Security Standard (PCI DSS)

BSI C5 Type 2

KRITIS Proof according to § 8a para. 3 BSIG

Trusted Cloud Service

IDW PS 951 Type 2 (ISAE 3402)

VS-NfD

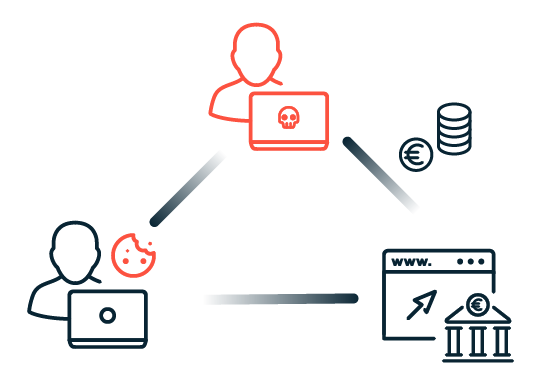

Protect your digital assets from harmful traffic

Do you have

questions?

Please contact us via contact form or call us at:

+49 89 414141 - 345.